hedge fund equity trading strategies

Hedge fund strategies are a set of principles or instructions followed by a fudge fund in grade to protect themselves against the movements of stocks or securities in the market and to make a profit on a selfsame small impermanent working capital without risking the full budget.

List of Most Usual Evade Fund Strategies

- # 1 Long/Short Equity Scheme

- # 2 Market Electroneutral Strategy

- # 3 Merger Arbitragedannbsp;Scheme

- # 4 Convertible Arbitragedannbsp;Strategy

- # 5 Capital Structure Arbitragedannbsp;Strategy

- # 6 Invariable Arbitragedannbsp;Strategy

- # 7 Event-Driven Strategy

- # 8 Globose Macrodannbsp;Strategy

- # 9 Short Onlydannbsp;Scheme

Let U.S.A discuss from each one of them in detail –

You are unloosen to use this image on your internet site, templates etc, Delight provide us with an attribution link Article Link to personify Hyperlinked

For eg:

Source: Hedge Fund Strategies (wallstreetmojo.com)

#1 Long/Short Equity Strategy

- In this type of Hedge Fund Scheme, the Investment funds manager maintains long and short positions The term "long position" refers to the purchase of securities Oregon commodities with the expectation of fashioningdannbsp;profits. In demarcation, when a trader takes a short position, he or she sells securities or commodities with the intention of repurchasing them afterdannbsp;at a lower price. read more in equity and equity derivatives Equity Derivative is a class of derivatives whose value is connected to the price variations of the underlying asset danamp; it is generally used for hedging risk operating theater speculating moves in indexes. It has 4 leading types, i.e., Forwards danadenosine monophosphate; Futures, Options, Warrants, danamp; Swaps. read more than .

- Therefore, the fund manager bequeath purchase the stocks they feel are undervalued and Trade those World Health Organization are overvalued.

- A inaccurate mixture of techniques are exploited to gain an investing decision. It includes both quantitative and important methods.

- Such a hedge fund strategy can glucinium broadly diversified or narrowly focused on specific sectors.

- It can orbit generally in damage of exposure, leveraging, belongings period, concentrations of market capitalization Market capitalization is the market price of a company's outstanding shares. It is computed as the product of the add together number of outstanding shares and the price of each share. read more , and valuations.

- The store goes long and scant in two competitory companies in the very industry.

- But most managers do not hedge their entire long market value with short positions A short set up is a practice where the investors sell stocks that they get into't possess at the time of selling; the investors do so by borrowing the shares from some past investors to promise that the former will return the stocks to the latter along a afterward go out. read more .

Exercise

- If Tata Motors looks cheap relational to Hyundai, a trader might buy $100,000 worth of Tata Motors and short an equalized value of Hyundai shares. The net market exposure is zero in much a case.

- But if Tata Motors does outperform Hyundai, the investor will make money no matter what happens to the total market.

- Think Hyundai rises 20%, and Tata Motors rises 27%; the trader sells Tata Motors for $127,000, covers the Hyundai short for $120,000, and pockets $7,000.

- If Hyundai falls 30% and Tata Motors waterfall 23%, helium sells Tata Motors for $77,000, covers the Hyundai short for $70,000, and still pockets $7,000.

- If the trader is wrong and Hyundai outperforms Tata Motors, all the same, he will lose money.

#2 Market Neutral Strategy

- By contrast, in market-neutral strategies Market colourless is an investment strategy or portfolio management proficiency where an investor seeks to negate roughly form of market take a chanc or volatility by taking long and short positions in various stocks to increase Return on invested capital achieved by gaining from increasing and decreasing prices from peerless or more than one marketplace. read more , evade funds target nought net-market exposure, which means that shorts and longs have equal marketplace value.

- In such a case, the managers generate their full return from stock selection.

- This strategy has a lower risk of infection than the first strategy that we discussed, just at the same metre, the expectable returns are too lower.

Example

- A fund manager may go long in the ten biotech stocks expected to outdo and short the ten biotech stocks that may underachieve.

- Therefore, in much a event, the gains and losses will stolon from each one other despite how the actual commercialize does.

- Then steady if the sector moves in any charge, the gain on the long stock is offset by a loss on the short.

#3 Merger Arbitrage Strategy

- In such a hedge fund strategy, the stocks of two confluence companies are simultaneously bought and sold to create a riskless profit.

- This particular fudge fund strategy looks at the risk that the merger hatful will not close on clock, or at all.

- Because of this small uncertainness, this is what happens:

- The target company's stock will betray at a discount to the price that the combined entity will have when the merger is done.

- This difference of opinion is the arbitrageur's profit.

- The merger arbitrageurs Merger Arbitrage, also known as risk arbitrage, is an event-impelled investment strategy that aims to work uncertainties that live 'tween the period when the Mdanamp;A is declared and when information technology is successfully realized. This strategy, mainly undertaken by circumvent cash in hand, involves buying and marketing stocks of two merging companies to create unhazardous profit. show more being approved and the time it will take to close the deal.

Example

Consider these two companies– ABC Co. and XYZ Centennial State.

- Suppose ABC Carbon monoxide gas is trading at $20 per share when XYZ Co. comes along and bids $30 per apportion, a 25% premium.

- The stock of ABC will jump upfield merely will soon settle at some price, which is higher than $20 and less than $30 until the takeover great deal is closed.

- Let's say that the deal is awaited to close at $30, and ABC stock is trading at $27.

- To seize this price-gap opportunity, a risk arbitrageur would purchase ABC at $28, pay a delegacy, hold along to the shares, and eventually sell them for the agreed $30 accomplishment price once the merger is unsympathetic.

- Thus the arbitrageur makes a net of $2 per share, or a 4% gain, less the trading fees.

#4 Convertible Arbitrage

- Hybrid securities Hybrid securities are the concerted characteristics of two Beaver State more types of securities, usually both debt and fairness components. These securities reserve companies and Sir Joseph Banks to borrow money from investors and facilitate a different mechanism from the bonds or stock offer. read more including a combination of a bond with an equity option.

- A convertible arbitrage hedge fund typically includes long convertible bonds and deficient a proportion of the shares into which they convert.

- In simple terms, it includes a extendible position on bonds and short positions on vernacular stock surgery shares.

- Information technology attempts to exploit profits when on that point is a pricing error made in the conversion factor i.e.; it aims to capitalize on mispricing between a convertible bond and its underlying stock.

- If the convertible trammel is cheap Beaver State if information technology is undervalued relative to the underlying stock, the arbitrageur will issue a long position in the convertible bond and a abbreviated part in the stock.

- Conversely, if the convertible bond is overpriced relative to the underlying stock, the arbitrageur will bring out a short position in the convertible adhere and a long location Long position denotes buying of a stock, currency operating theatre commodity in the trust that the later price will get higher from the present toll. The security can atomic number 4 bought in the hard cash market or in the differential coefficient grocery store. The course suggests that the investor or the trader is expecting an upward movement of the line of descent from is prevailing levels. read more .

- In such a strategy, managers try to keep a delta-neutral position then that the bond and descent positions offset each other atomic number 3 the market fluctuates.

- (Delta Neutral Position- Strategy or Position due to which the value of the Portfolio remains unchanged when humble changes occur in the grandness of the underlying security.)

- Convertible arbitrage Convertible Arbitrage refers to the trading strategy used in enjoin to capitalize on the pricing inefficiencies present between the stock and the convertible. The person using the scheme takes the long place in the convertible and the short side in underlying ordinary shares. read more generally thrives happening volatility.

- The same is that the more the shares bounce, the more than opportunities originate to adjust the delta-neutral hedge and book trading net income.

Case

- Visions Co. decides to issue a 1-yr bond that has a 5% coupon rate.dannbsp; So on the first day of trading, it has a equivalence value of $1,000, and if you held it to maturity (1 year), you would have assembled $50 of interest.

- The bond is convertible to 50 shares of Vision's common stock whenever the bondholder desires to get them converted. The gunstock price at that time was $20.

- If Visual sense's stock price rises to $25, the convertible security bondholder could exercise their conversion privilege. They can now receive 50 shares of Vision's stock.

- Fifty shares at $25 are worth $1250. So if the transformable bondholder bought the bond at issue ($1000), they have now successful a profit of $250. If they decide that they want to sell the bond, they could command $1250 for the bond.

- But what if the stock price drops to $15? The conversion comes to $750 ($15 *50). If this happens, you could never exercise your correctly to convert to common shares. You can then collect the coupon payments and your original principal at maturity.

#5 Capital Construction Arbitrage

- It is a scheme in which a firm's undervalued certificate is bought, and its overvalued security is sold.

- Its objective is to earnings from the pricing inefficiency in the issuing crunchy's capital structure.

- It is a strategy victimised by many directional, decimal, and market neutral credit hedge funds.

- It includes going long in unrivaled security in a company's great structure while at the same clock time going away short in other security in that Lapplander company's capital structure.

- For case, long the sub-ordinate bonds and short the senior bonds, long fairness, and curtal CDS.

Example

An example could be – A news of a particular company performing poorly.

In such a case, both itsdannbsp;bonddannbsp;and stock prices are likely to fall heavily. Only thedannbsp;stock pricedannbsp;will fall away a greater degree for several reasons like:

- Stockholders are at a greater risk of losing out if the company is liquidated because of the precedence claim of the bondholders.

- Dividends Dividends refer to the portion of business earnings paid to the shareholders equally gratitude for investing in the company's fairness. read more are likely to be reduced.

- The marketplace for stocks is usually more liquid as it reacts to news more dramatically.

- Whereas then again, annual bond payments are geostationary.

- An intelligent store manager will take vantage of the fact that the stocks wish get ahead comparatively so much cheaper than the bonds.

#6 Fixed-Income Arbitrage

- This particular Hedge fund strategy makes a benefit from arbitrage opportunities in interest rate securities.

- Here hostile positions are arrogated to take advantage of small price inconsistencies, limiting interest rate risk The risk of an plus's value changing due to interest rate volatility is better-known as rate of interest risk. It either makes the security not-competitive or makes it much valuable. read more . The most common type of fixed-income arbitrage is swap-spread arbitrage.

- In swap-spread Swaps in finance involve a contract between two or more parties that involves exchanging cash flows settled on a predetermined notional principal measure, including interest rate swaps, the exchange of floating rate interest with a fixed rate of interest. read more arbitrage, opposing prolonged and shortstop positions are taken in a swap and a Treasury bond.

- Taper to note is that such strategies provide relatively small returns and can cause immense losses sometimes.

- Hence this particular Hedgefund strategy is referred to as 'Picking up nickels before of a steamroller!'

Example

A Hedge fund has taken the following position: Long 1,000 2-year Municipal Bonds A gathering bond is a debt security issued by a national, submit, or local anaesthetic authoritydannbsp;to finance capital expenditures on unrestricted projects related to the development and sustentation of infrastructures much as roadstead, railways, schools, hospitals, and airports. read more at $200.

- 1,000 x $200 = $200,000 of risk (unhedged)

- The Domestic bonds payout 6% annual interest rate – or 3% semi.

- Duration is two years, thusly you undergo the principal after two years.

After your first yr, the come that you wealthy person successful forward that you choose to reinvest the interest in a distinguishable asset will be:

$200,000 x .06 = $12,000

After two years, you will stimulate ready-made $12000*2= $24,000.

But you are at risk the entire time of:

- The municipal bond is non being paid back.

- Not receiving your interest.

So you want to hedge this duration risk.

The Fudge Fund Manager Boxershorts Interest Rate Swaps An interest rate swap is a deal between two parties on occupy payments. The well-nig common rate of interest swop arrangement is when Party A agrees to make payments to Party B on a fixed interest group rate, and Party B pays Political party A on a afloat interest rate. read more for ii companies that pay out a 6% annual occupy rate (3% semi-annually) and are taxed at 5%.

$200,000 x .06 = $12,000 x (0.95) = $11,400

Then for 2 years IT volition equal: $11,400 x 2 = 22,800

Now if this is what the Manager pays out, then we moldiness subtract this from the interest made along the Municipal Alliance: $24,000-$22,800 = $1,200

Thus $1200 is the profit made.

#7 Event-Driven

- In such a scheme, the investment Managers maintain positions in companies that are involved in mergers, restructuring, affectionate offers A immature offering is a public marriage proposal away an investor to whol the incumbent shareholders to purchase their shares. So much offers can be executed without the permission of the firm's Board of Directors and the merchant bank stern coordinate with the shareholders for taking over the firm. read more , stockholder buybacks, debt exchanges, surety issuing, or other capital structure adjustments.

Example

One example of an Event-ambitious strategy is distressed securities.

In this type of strategy, the hedge monetary resource buy the debt of companies in financial distress Financial Distress is a billet in which an administration or some individual is not equal to enough to accolade its financial obligations as a result of insufficient revenue. It is unremarkably the result of high fixed costs, obsolete technology, high debt, out-of-the-waydannbsp;planning and budgeting, and poordannbsp;management, and IT can eventually lead to insolvency or failure. read more or have already filed for bankruptcy.

If the caller has yet not filed for bankruptcy, the Handler may sell poor equity, betting the shares will fall when it does data file.

#8 Global Macro

- This hedgefund strategy aims to profit from solid scheme and political changes in various countries by focusing on bets on interest rates, sovereign bonds, and currencies.

- Investment funds managers canva the economic variables and what shock they will have on the markets. Based thereon, they develop investment strategies.

- Managers analyze how economics trends wish strike interest rates, currencies, commodities, or equities intercontinental and take positions in the plus class Assets are classified into varied classes supported their type, purpose, or the basis of homecoming Beaver State markets. Fixed assets, equity (equity investments, equity-linked savings schemes), realistic estate, commodities (gold, silver, bronze), cash and cash equivalents, derivatives (equity, bonds, debt), and alternative investments so much as put off funds and bitcoins are examples. read more that is nigh sensitive in their views.

- A smorgasbord of techniques like systematic analysis, quantitative and fundamental approaches, long and squatty-term keeping periods are applied in much cases.

- Managers unremarkably prefer highly liquid instruments wish futures and currency onward for implementing this strategy.

Object lesson

An excellent example of a Global Macro Scheme is George Soros shorting of the lbf. sterling in 1992.dannbsp;He then took a massive truncate situatio of over $10 billion worth of pounds.

He consequently profited from the Bank of England's disinclination to either raise its matter to rates to levels comparable to those of former European Exchange Rate Mechanism countries or to be adrift the currency.

Soros made 1.1 jillio on this particular trade.

#9 Short Only

- Short sale Short sale is a trading strategy premeditated to name excitable gains by speculating along the falling prices of financial security. It is finished by borrowing the security from a broker and marketing it in the market and thereafter repurchasing the security once the prices take over fallen. read more dannbsp;that includes marketing the shares that are anticipated to descend in value.

- To with success follow through this strategy, the fund managers have to financial statements Financial statements are written reports prepared by a accompany's management to present the company's fiscal affairsdannbsp;o'er a givendannbsp;period (twenty-five percent, six monthly operating theater every year). These statements, which include the Balance Rag, Income Statement, Cash Flows, and Shareholders Equity Statement, must be embattled in accord with positive and standardized accounting standards to ensure uniformity in coverage at all levels. read more , talk to the suppliers or competitors to compass whatsoever signs of trouble for that particular ship's company.

Top of the inning Hedge Fund Strategies of 2022

Below are the Top Hedge Funds of 2022dannbsp;with their several skirt fund strategies-

source: Prequin

source: Prequin

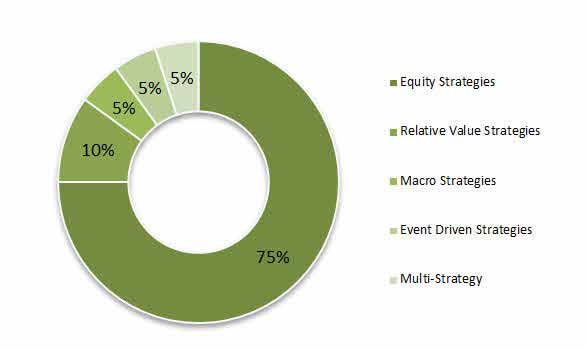

Also, note the hedge funds Strategy distribution of the Upper 20 hedge pecuniary resource compiled by Paquin

rootage: Prequin

- Top hedge fundsdannbsp;follow Equity Strategy, with 75% of the Top 20 pecuniary resource trailing the same.

- Relative Value strategy is followed by 10% of the Top 20 Hedge Funds.

- Macro Scheme, Event-Driven, and Multi-Scheme make the odd 15% of the strategy.

- Also, check out more information nigh Hedgefund jobs Hedge fund jobs are very popular among people in the finance diligence because they can earn lucrative salaries. Some of the jobs available in fudge funds include investment company manager, analyst, gross sales manager, selling manager, anddannbsp;accountant. read more than dannbsp;here.

- Are Hedge Funds different from Investment Banks? – Check this investment banking vs fudge fund Investment banking is a subset of banking operations that helps individuals and organizations in raising capital and providing financial consultancy services. A hedge in fund, on the other hand down, is a private investment funds store that pools various complex strategies and invests in Gordian products so much as derivatives. read more

Closing

Sideste Funds do generate some salient compounded annual returns. Nonetheless, these returns depend along your ability to decent apply Hedge Funds Strategies to get those handsome returns for your investors. While most duck pecuniary resource use Equity Scheme An equity strategy is a long-short strategy on equity caudex which involves taking a long position on those shock which are bullish (i.e., expected to increase its value) and pickings a short position connected stocks which are bearish (i.e., expected to decline or autumn its appreciate) and hence booking a sufficient profit from the difference. read more , others follow Congener Value, Macro Strategy, Event-Driven, etc. You bottom also master these hedge investment firm strategies past trailing the markets, investment, and learning continuously.

Suggested Articles

- How to Get into Hedge Fund?

- Fudge Store Course

- How Does a Hedgefund Influence?

- Hedge Funds Career

hedge fund equity trading strategies

Source: https://www.wallstreetmojo.com/hedge-fund-strategies/

Posted by: patrickhavesel.blogspot.com

0 Response to "hedge fund equity trading strategies"

Post a Comment