price dynamics of common trading strategies

Former university professor of marketing and communications, Sallie is an independent newspaper publisher and marketing communications consultant.

A exemplary Wal-Mart Supercenter in Orangeburg, SC. All marketers love the theme of good parking mountain of customers who are ready and waiting and eager to purchase their products.

Attitude2000 [CC-BY-SA-3.0 or GFDL, via Wikimedia Commons.

Riddle: What is that has just about everything available for a song, but causes trembling vibrations and the sound of doors slamming closed, permanently, wherever it goes? Answer: The opening of a new Wal-Mart store.

Hundreds of neighborhood businesses, approximately the nation and the world, have felt the impact of the opening of a new Wal-Mart store. Many take over constitute prohibited, after the giant retailer came to town, that having such a big refreshing neighbor meant the end of their business. They simply could not compete because Wal-Mart uses a pricing scheme that knocks them completely out of the packing arena. Why? Because most small retailers do not have the kind of bargaining king that Wal-Mart has with suppliers. They cannot compete on price with a company that owns more than 10,000 stores worldwide.

This article is not about the Wal-Mart phenomenon, but the phenomenon does underscore how vital the conception of Mary Leontyne Pric is in the marketplace. Non just for mom and pop retailers, but also for manufacturers and marketing executives besides. Pricing decisions are make-or-break decisions for businesses, and for this reason, decisions about pricing mustiness be made with great care, attractive into thoughtfulness an incredibly complex array of environmental and competitive concerns.

In this article, I will be looking not at how a accompany sets a single price, but rather at how companies adopt pricing structures that testament book binding different items in a business line. When a troupe makes or markets more than one product, pricing methods are needed that take into consideration altogether of the company's market offerings.

New-Cartesian product Pricing Strategies

Pricing structure usually changes over clip as a company's products move through their living cycles. When a new troupe is bringing a new product to market, IT is presented with the challenge of setting prices for the first fourth dimension. In this office, a company can choose between two spacious strategies, grocery store-skimming pricing or market-penetration pricing.

Grocery store-Skimming Pricing

Market skimming is a scheme that works for a new ware that is also a new type of product: One that has no copycat competitors or substitutes, yet. Companies that make original new products can lot high initial prices allowing them to "skim" revenues from the commercialize. But market-skimming pricing exclusive works under certain conditions:

- Condition #1: The product's quality and image must be strong enough to support its swollen Leontyne Price, and enough buyers mustiness want and be willing to bargain the product at the high-topped price.

- Condition #2: Costs committed in producing a smaller volume of the product cannot be then high that they "eat up" the advantage of charging more.

- Condition #3: It cannot be easy for competitors to enter the market and swiftly undercut the soaring price.

With market-skimming pricing, the goal is to siphon disconnected maximum revenues possible from the market prior to the institution of substitutes or copycat offerings. Once the market has been skimmed, the company is free to lower the price, drastically, to capture low-end buyers while version competitors incapable to vie on monetary value.

Primitively used by dairy farm farmers to moderate and protect cattle` udders from windward extremes and milking, Happy Cow Moisturizing Udder Balm is the original chemical formula that was developed and manufactured by the Qualis Corporation.

Away Sandahl46 GFDL or CC-BY-SA-3.0 via Wikimedia Commonality.

Market-Penetration Pricing

Achieving an initial high volume of sales, with a new product, is the particular object of market-penetration pricing. Instead of setting a high price to cream off small but profitable segments of the total market, a company can choose to use market-penetration pricing. Although this strategy calls for a product to be wide promoted, it allows the mount of a contralto initial price enabling the company to fathom the market rapidly and deeply. Using the commercialise-penetration strategy, the company give the sack attract a large figure of buyers quickly while it also captures a large share of the market. At that place are conditions that must be met, however, for market-penetration pricing to work:

- Condition #1: The market for the product must be highly damage reactive so that a scummy price produces more market growing.

- Condition #2: The market must live large enough to sustain low profit margins, and production and distribution costs must fall as gross sales volume increase.

Say More From Toughnickel

- Condition #3: The low Price must help keep out the competition.

- Condition #4: The companionship must be able to keep out its baritone-price position—other than, the Leontyne Price vantage will make up only temporary. Formerly competitors enter the market, they may also lower prices.

Members of the Sony Walkman ancestry of products; photo by Marc Zimmermann.

I GFDL, CC-BY-Sturmarbeiteilung-3.0 surgery GFDL, via Wikimedia Commons.

Product Mix Pricing Strategies

When a company produces a line of products and/or services, they have what is called a "cartesian product mix." A company's objectives, when setting prices for a product mix, is fairly different from setting prices for a single product or service. In pricing for a product mix, the companionship is seeking a set of prices that will allow it the most benefit potential from merchandising a mix of products. There are 5 basic mathematical product-mix pricing strategies; product-wrinkle pricing, optional-product pricing, captive-product pricing, by-product pricing, and product-bundle pricing.

Product-Line Pricing

Product quality, real or perceived, is used in cartesian product-line pricing. When a company offers a note of products, intersection-line pricing is used to separate market offerings aside price gaps between categories. The price gaps are wont to alert interested buyers to real or sensed differences in the tone of offerings. Established price points of competitive offerings are a great deal used in the setting of different prices for several products in the line of work. Retailers use of goods and services this approach to separate goods into cost categories too, indeed that customers can witness distinctions in levels of quality of merchandise.

Elective-Intersection Pricing

This method acting allows a company to set a low Mary Leontyne Pric for its virtually basic mathematical product or service, while offering desirable/needed add-on accessories or services that are costly. This method allows the company additional shipway to profit. Companies/industries using optional-product pricing include airlines and cell phone companies. Victimisation nonobligatory-product pricing, the accompany's challenge is to determine what to let in on with the price of its base offer, and what to pose as optional.

Captive-Product Pricing

This method is used aside companies that commercialise their own supplies for a main product, when the main product is sold separately. Using this method acting, the company bequeath usually set prices low for the main product, but will have high mark-ups connected the supplies needed for use it. E.g., makers of computer printers use this method by oblation printers at comparatively low prices, with printer ink cartridges being offered at substantial prices. Products much as computer software, staples, and razor blades, also provide good examples of this method.

In the incase of services, the intent-pricing method is called multilateral pricing. Part peerless is a unmoving fee for a basal service (for example, a leased automobile, or duplicator machine). Part ii of the service is a variable custom rate (usage rate, in the example of leased auto, would beryllium based on mileage; for the leased copier, on the number of copies made). Exploitation this method, it is up to the inspection and repair firm to decide what the pricing should be for use of the basic Service and the variable exercis rate.

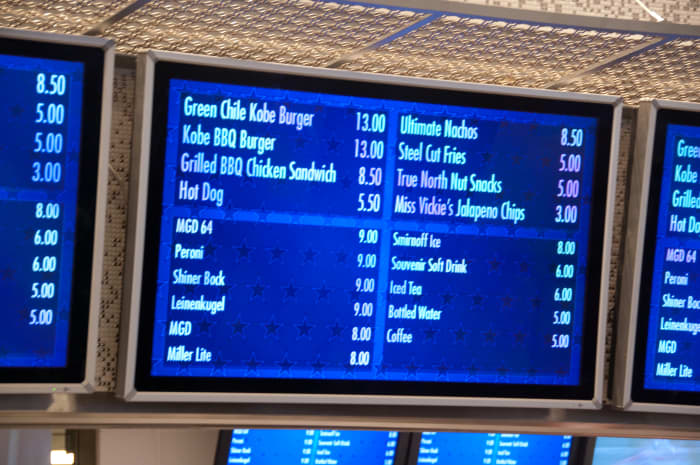

In summation to "captive-product pricing" there is also "captive-market pricing." Sports arenas are thoroughly examples of a "prisoner market," with no competitive products/services.

Aside Mahanga (Own work) GFDL or 200-BY-Sturmarbeiteilung-3.0, via Wikimedia Green.

Spin-off Pricing

Sometimes, the manufacturing sue results in production of a useful, and therefore marketable, by product. When there is a market for the by-product, byproduct pricing is a method that can allow a manufacturer to obtain a competitive advantage by charging a lower price for the briny product (since devising the product produces something other of prise). By-products can be of no, little, or great prize. When they are of value, marketers prat assume a price that offers little more than the cost of storing and delivering them, or, they can have significant time value. Some examples of profit-making by-products let in, lanolin (comes from the cleaning of wool); whey (from cheese manufacturing), and asphalt (from the refining of crude oil).

Product Bundle Pricing

This method acting calls for the "bundling" of several products which are offered for sale as a combined unit. The price of each item exclusive the bundle is usually belittled from what the price would be for the item, if purchased separately. Purchasing the bundled unit allows buyers to get down each item in the bundle at a reduced price. This method allows marketers to include in a bundle few items that, alone or one by one, might not Be equally popular with consumers as other items in the bundle.The price must be low enough, nonetheless, for the "packet consider" to be attractive to consumers. Transmission line television, call up/telecommunications services companies, and fast-food marketers use bundle pricing much and effectively.

There are many different and complex ways that pricing can be approached, however, the bottomline rules of pricing are simple and straightforward. When information technology comes to pricing, the most measurable matter to commend is that prices mustiness be placed in a right smart that will cover costs and profits. With this in psyche, pricing must be bendable, because prices should always be in line with changing costs, consumer demand, agonistical pricing moves, and profit goals. When the time comes that there is a take to lower prices, the company should first find a agency to lower costs, because pricing should always be done in a elbow room that volition see to it gross sales and profit.

This article is precise and true to the record-breaking of the source's knowledge. Cognitive content is for informational or entertainment purposes only and does non substitute for syntactic category counsel or nonrecreational advice in business, financial, learned profession, or technical matters.

© 2022 Sallie B Middlebrook PhD

price dynamics of common trading strategies

Source: https://toughnickel.com/business/Product-Pricing-Strategies

Posted by: patrickhavesel.blogspot.com

0 Response to "price dynamics of common trading strategies"

Post a Comment