the handbook of exotic trading strategies pdf

Trading the markets with scalping trading strategies can be an implausibly tickling way to trade.

You can get in and out of your trades in moments and you can make profit in umpteen different markets.

In this post we go game through exactly what scalping is, if it is for you and how you can employment it in your trading.

Annotation: You terminate download your liberated Scalping Trading Strategies PDF Below.

Free PDF Guide: Get Your Scalp Trading Strategies PDF Guide

What is Scalping?

Scalp trading or scalping is a higher risk trading strategy that if cooked correctly can come with higher rewards.

The reason many traders are attracted to scalping on the smaller time frames suchlike the 5 minute and 1 minute charts is because there are very much of opportunities to make trades.

When scalping you will be able to skip over in and out of trades in minutes and make profits from precise small movements that price makes higher or lower.

When trading markets look-alike Forex you will be able to trade long-acting and short and will likewise be fit to get hold trades that are making strong trends for long periods.

As we will devour in that billet, scalping lavatory open the way for malodourous reward trades exploitation some very simple strategies.

Why Would You Want to Scalp Trade?

Scalping is emphatically not for everyone.

Scalping can often involve high risk levels and you will motive to be switched connected and watching your charts at all times.

Not only will you deman to constitute switched on and watching for potential trades, but when you are in a trade you bequeath demand to be monitoring it perpetually because the markets can change rapidly.

Consider the following to see if scalping is for you;

Scalping is for you if:

- You want quick trades and to know if you won or lost quickly.

- You want many trading opportunities.

- You Don't want to hold your trades overnight.

- You are happy with smaller spot gains.

Scalping is not for you if:

- You don't need to be jumping in and impermissible of trades every few minutes.

- You are much suited to swing trading.

- You are not comfortable with riskier trading strategies.

Scalping vs Day Trading

Scalping is standardized in many ways to day trading. With both strategies you will be trading during the one session and not retention your trades.

The of import difference 'tween scalping and day trading is that day traders will normally pick one or two trades to hold for the session. Day traders will often analyze their trades longer and will have a longer trade property period.

Scalp traders are using much smaller time frames such as the 5 small and 1 minute charts to promptly alternate in and down of trades.

Scalpers are relying on making profits from very small terms movements in a very nimble sentence, whereas day traders can exist holding their trades for hours with far bigger pip gains.

Optimal Indicators for Scalping

Extraordinary of the best indicators to scalp the markets is the moving average and particularly the exponential moving average or EMA.

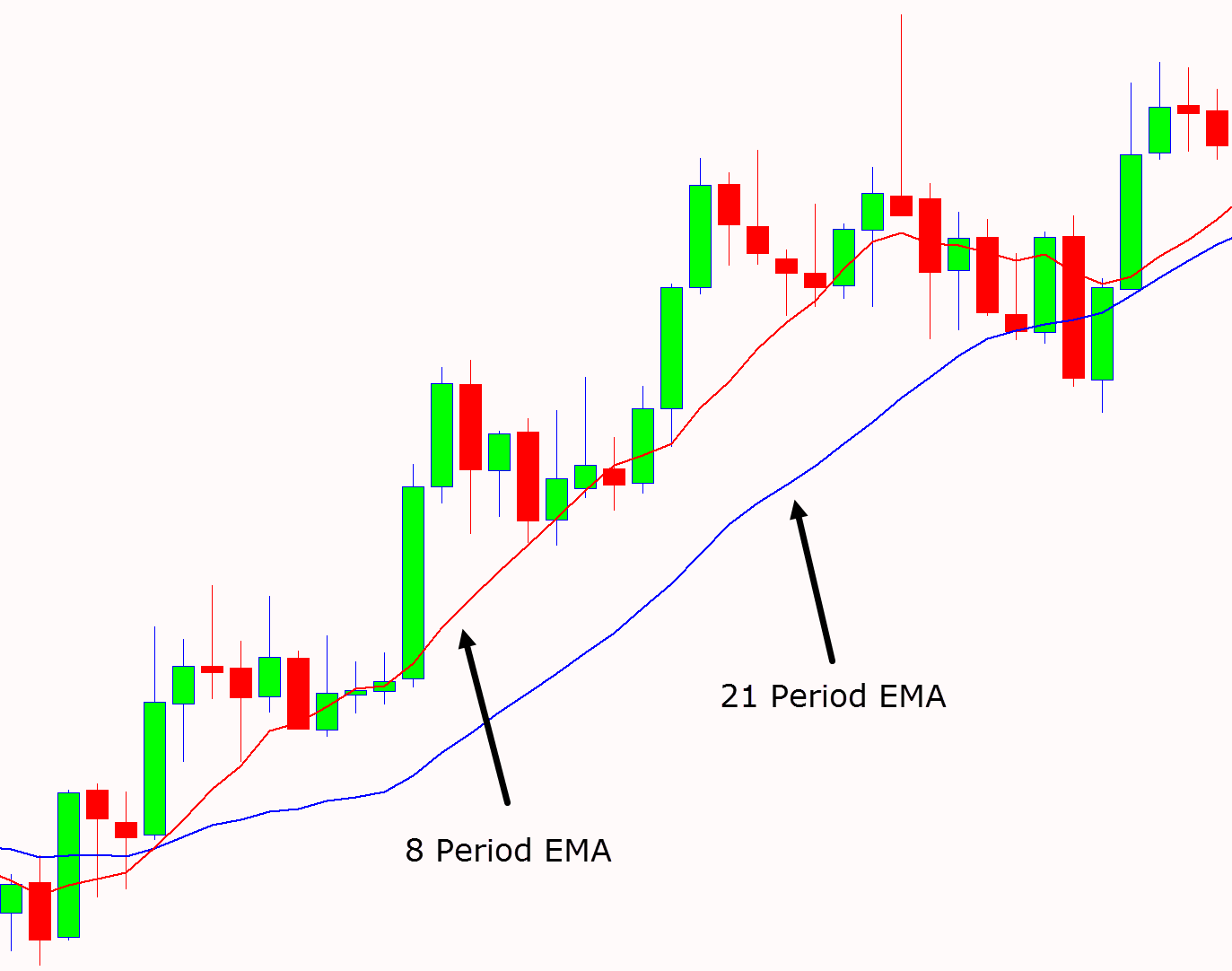

Non only can the EMA help you ascertain trends in the markets, merely when you utilization two different EMA's it can assistant you identify the strength of a trend.

Learn about how to function EMA's in your trading here.

The example below shows two EMA's added to the chart. These EMA's are the 21 and 8 geological period.

Oft when swing trading you leave practice longer period moving averages like the 50 or 200 period, but when scalping you need shorter period EMA's to find the rapidly changing impulse.

In the case below we can see the 8 period EMA has crossbred the 21 period EMA and terms is powerfully trending higher leading to potential bullish long scalping trades.

Profitable Forex Scalping Strategy

A lot of the very popular and triple-crown scalping trading strategies have the same things in common.

When using a scalping scheme you want to looking at for a scheme that has;

- Small stops and tight risk management.

- Trades that have the potential to make conspicuous reward profits.

- Markets and Forex pairs with small spreads that don't eat into your net.

- Markets that have a wad of volatility and give plenty of trading opportunities.

- About heavily traded Forex pairs that can oft trend on small time frames for long periods.

The unexceeded scalping strategies will allow you to find many expected trading opportunities. This will give you the chance to reach many trades, simply as wel comb out the bad setups.

You should also be mindful of Forex pairs and past markets where there is a high cost to trade and high spreads. This will hit it incredibly hard to be profitable when scalping.

When scalping you will be using small stops and the best strategies leave set aside you to find large risk reward fetching trades that will cover your losses and make you profitable.

5 Minute Scalping Strategy

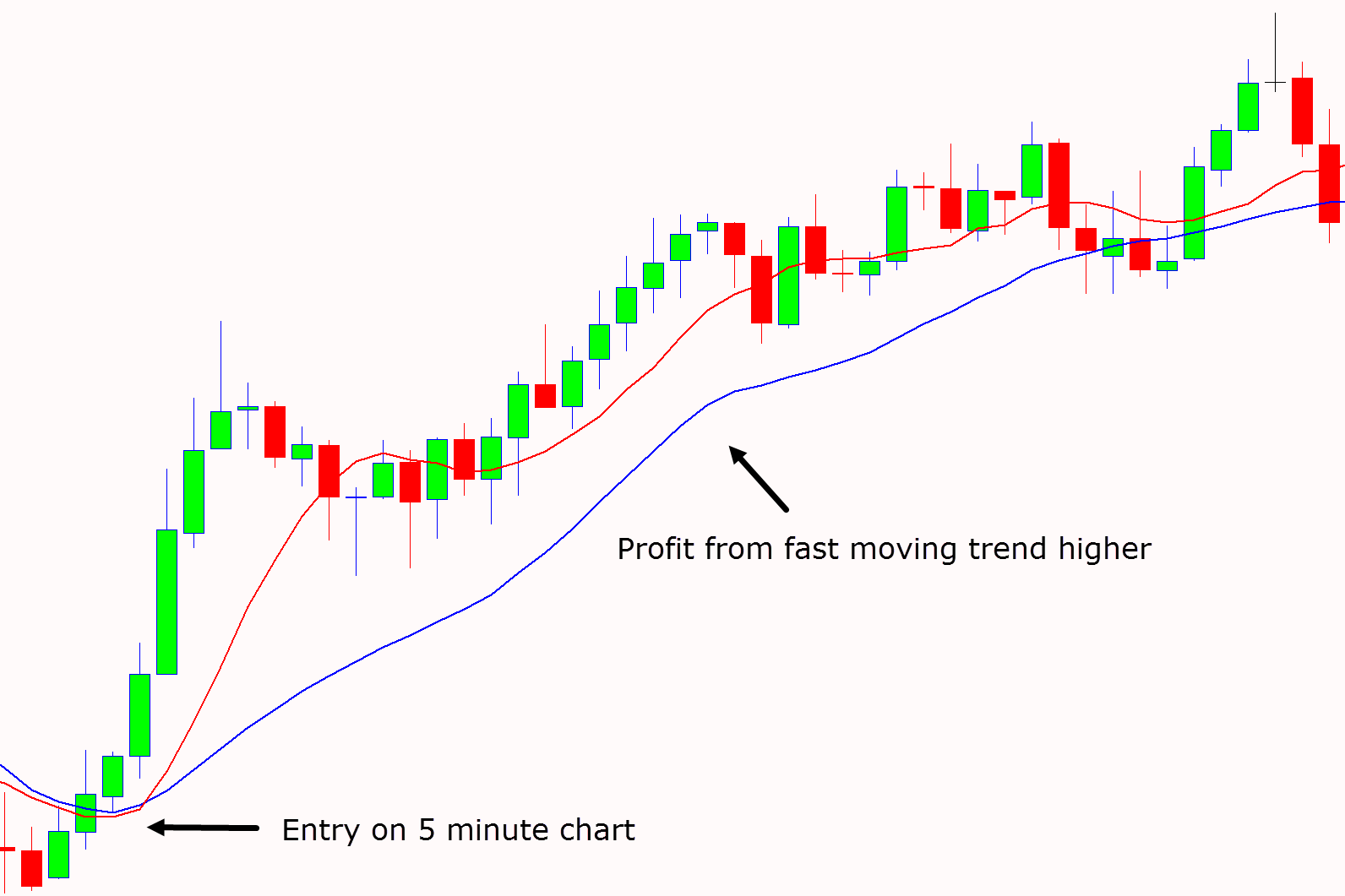

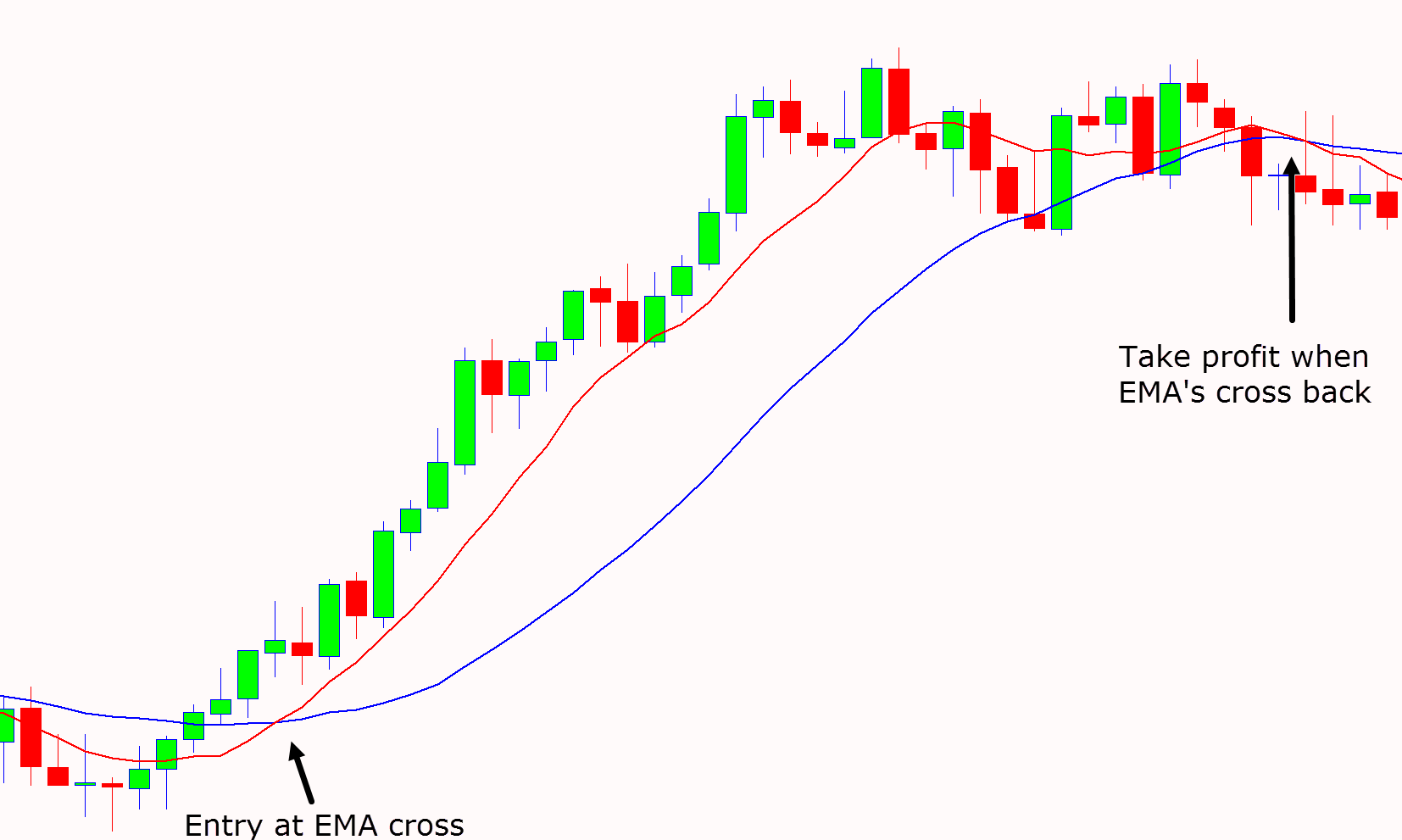

The key to this 5 minute scalping strategy is determination a strong trend with a moving average crossover.

When the 8 period tumbling average crosses the 21 period moving average and begins to widen we put up get down to look for trades in the direction of the trend.

In the example at a lower place; the 8 period exponential road average crosses above the 21 period moving middling and starts a strong trend higher.

Trades could then be hunted using other confluences such Eastern Samoa using Japanese candlesticks for entry points operating room major areas of provide and demand.

The stop loss could be trailed as either the 8 or 21 stop moving average depending on how aggressive you are with your trade management.

1 Bit Scalping Scheme

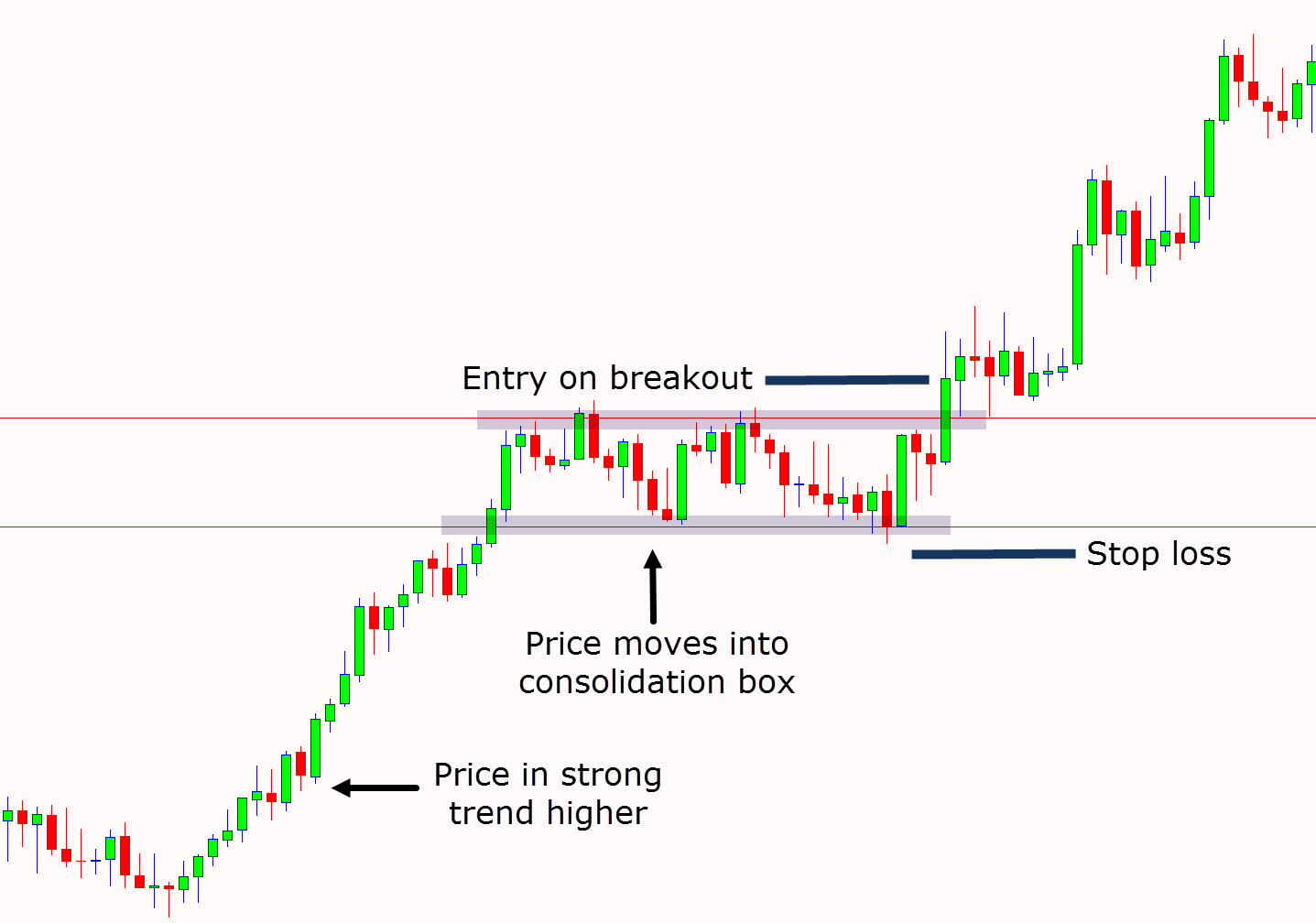

The key to this strategy is first identifying an obvious trend either higher or lower.

Once you have found a trend you are then looking price to pause OR consolidate.

In the good example chart below you leave see price was in a unattackable trend higher before moving into a obliquely integration pattern.

We could then anticipate play the breakout trade inline with the active uptrend when price breaks through the resistance equal.

Lastly

Scalping the markets is definitely not suited for every monger. If you cerebrate scalping may be for you the outdo thing you can do is download discharge demo charts here and run out your trading with no risk using virtual money.

This way you will know if scalping is for you and if your strategy works.

the handbook of exotic trading strategies pdf

Source: https://learnpriceaction.com/scalping-trading-strategies-pdf-free-download/

Posted by: patrickhavesel.blogspot.com

0 Response to "the handbook of exotic trading strategies pdf"

Post a Comment